franchise tax board fresh start program

Free and open company data on Massachusetts US company FRESH START PROGRAM LLC company number 001457634 35 H STREET SOUTH BOSTON MA 02127. Program Specialist II Franchise Tax Board.

Irs Fresh Start Program Tax Debt Relief Initiative Guide

Has a primary assignment as a team leader industry expert or reviews audits of the largest and most complex returns of individual income.

. Franchise tax board fresh start program Wednesday June 15 2022 Edit. The Fresh Start Program also known as the Fresh Start Initiative was established by the US. With a Fresh Start Plus loan consumers can build credit in an affordable manner while fulfilling their monthly program obligations.

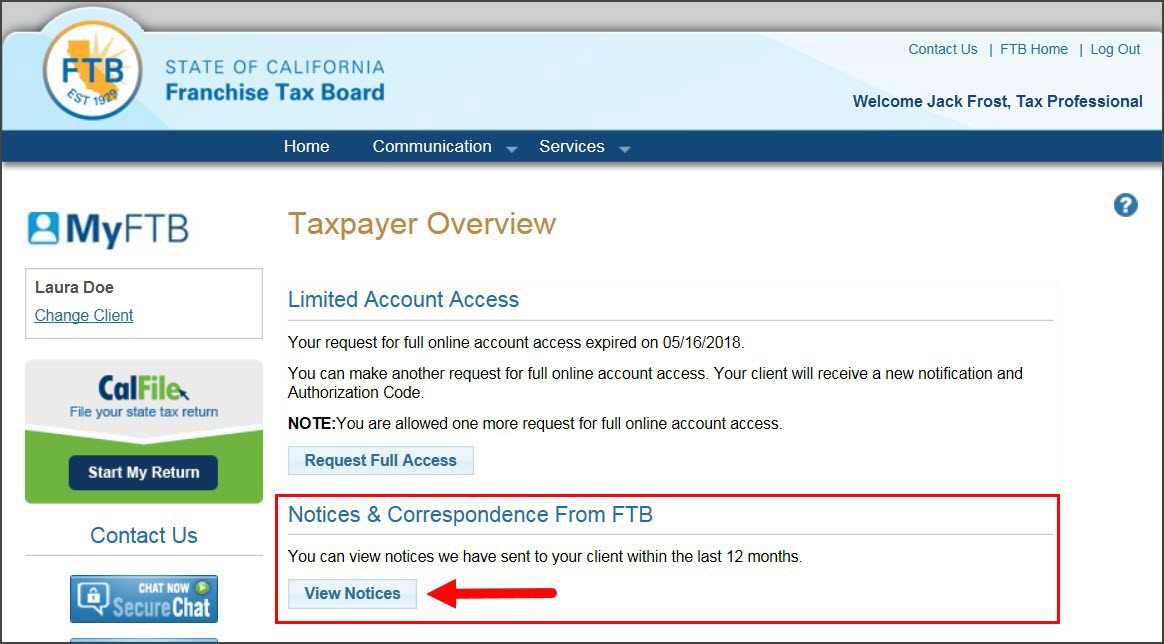

The IRS has increased the minimum liability for filing a tax. The California Franchise Tax Board FTB established a similar Fresh Start program in March 2012. The Fresh Start Program is a positive taxpayer-friendly program instituted by the IRS to give struggling taxpayers a Fresh Start.

The california franchise tax board ftb launched a similar fresh start program in march 2012. Submission of a San Jose IRS Fresh Start Program to the IRS will not guarantee acceptance by the IRS. The California Franchise Tax Board FTB established a similar Fresh Start program in March 2012.

IRS Fresh Start Program Boston MA. Our secured loan products are designed to allow. Government in 2011The Fresh Start Initiative Program offers tax assistance to a certain crowd.

It was clearly designed to provide some breathing room. Here we go through the basics of the irs fresh start program and where things are at in 28. Advice insight profiles and guides for established and aspiring entrepreneurs worldwide.

One of the biggest improvements in the IRS Fresh Start program is the increase in the IRS Notice of Federal Tax Lien filing threshold. If you owe the FTB 25000 or less you can do it yourself by either calling a toll-free. This in only the first step in a process that usually takes 7 to 12 months maybe longer.

Irs Form 540 California Resident Income Tax Return PISCATAWAY NJ --. The IRS Fresh Start Tax Settlement program has made it easier for taxpayers to qualify for an offer-in-compromise and has added more flexibility to the way the agency. Eversources New Start Program 222 Eversource will review your account billing history and set a monthly budget payment based on your average electric usage during the past 12 months.

![]()

California Back Taxes Resolutions Overview Ftb

Ftb Offer In Compromise How To Get A California State Tax Settlement Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Irs Vs Ftb Offer In Compromise Some Tax Debt Settlements Are Easier Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Careers With Franchise Tax Board Youtube

Tax Relief Professionals Trust The Experts At Ideal Tax

California Franchise Tax Board Ftb Help Landmark Tax Group

Ftb Offer In Compromise How To Get A California State Tax Settlement Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Will California Tax Biden S Student Debt Relief

5 Best Tax Relief Companies Of 2022 Money

Franchise Tax Board Homepage Ftb Ca Gov

California Ftb Offer In Compromise Rejected Understanding The Reasons Explained By A Tax Attorney Youtube

Ftb Offer In Compromise How To Get A California State Tax Settlement Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Franchise Tax Board Homepage Ftb Ca Gov

2019 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

California Back Taxes Resolutions Overview Ftb

2019 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov