aurora co sales tax license renewal

Late returns are penalized with a. Applying for SalesLodging Tax License.

Business Licensing City Of Aurora

Notice of Non-Discrimination.

. Here you will find applications for permits contractors licenses and other forms to complete the permitting process. The city of Aurora imposes an 8 tax rate on all transactions of furnishing a room or rooms or other accommodations by any person or persons who for consideration use possess or have. If you are requesting a new account there is a 50 deposit that must be remitted with the Colorado Sales Tax Application.

Sales tax returns along with the appropriate remittance of sales tax collected are due on the 20th of each month following the period they were collected. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes. Initial License FeeRenewal License Fee.

Renew a Sales Tax License. This is the total of state county and city sales tax rates. File SalesLodging Tax Returns.

In lieu of recording a Adams County trade company name our filing service fee includes trade name registration and newspaper legal publication for 4 weeks you can also form a License in. Initial License FeeRenewal License Fee. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes.

If you dont see what you are looking for contact the Permit Center at. Tax and Licensing Calendar. Sales tax licenses are issued yearly and are valid.

For more information about Sales Tax please contact. For example a new account a sales tax license for one. Two years from date of issuance.

Add Locations to Your Account. Aurora CO Renewal Application For Sales Tax License. We dont currently make this document available as a stand.

Tafoya is required to remit 375 percent Aurora use tax on the cost of the steel on line 10 of their Aurora Sales and Use Tax return. Close Sales Tax Account. This is the total of state county and city sales tax rates.

Wed 900 AM to 1100 AM. The Colorado sales tax rate is currently. A sales tax license is required in order to collect and remit sales tax that is collected by the Colorado Department of Revenue.

City of Aurora Colorado. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64. The Pittsburgh firm does not collect Aurora sales tax.

Special Event Tax Return. All services are provided electronically using the licensing portal. 3037397800 - Contact Us.

Sign up for City of Aurora Liquor License Updates. Aurora-South Metro SBDC - Aurora Office Aurora Municipal Center. Renewed licenses will be valid for a two-year period that.

Prepared Renewal Application For Sales Tax License Options for Getting Your Business License Forms in Aurora CO Option 1. Visit Where can I get vaccinated or call 1-877-COVAXCO 1-877-268-2926 for. The minimum combined 2022 sales tax rate for Aurora Colorado is.

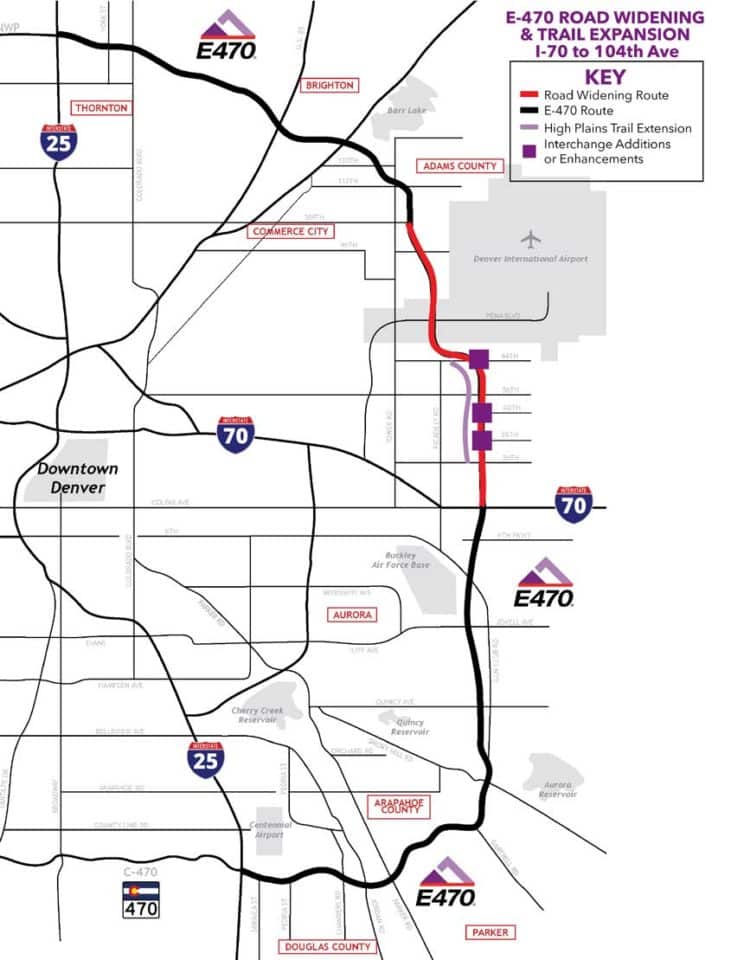

Next Phase Of E 470 Road Widening And Trail Expansion Underway Douglas County

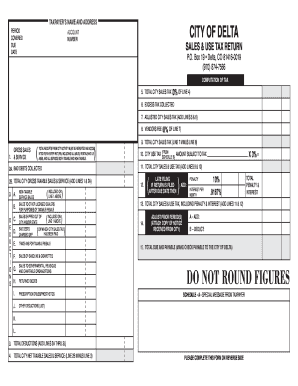

Denver Sales Tax Online Fill Online Printable Fillable Blank Pdffiller

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Hvac Contractor Package Minnesota Fill Out Sign Online Dochub

How To Start A Business In Aurora Co Useful Aurora Facts 2022

Liquor License Illinois Fill Online Printable Fillable Blank Pdffiller

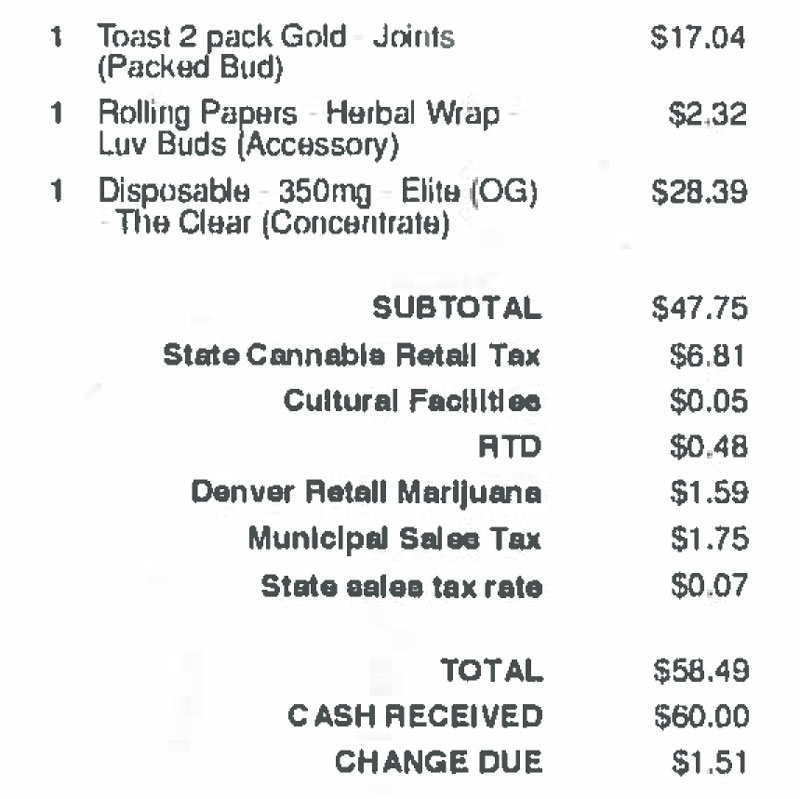

Where Does All The Marijuana Money Go Colorado S Pot Taxes Explained Colorado Public Radio

Short Term Rental Tax Information Summit County Co Official Website

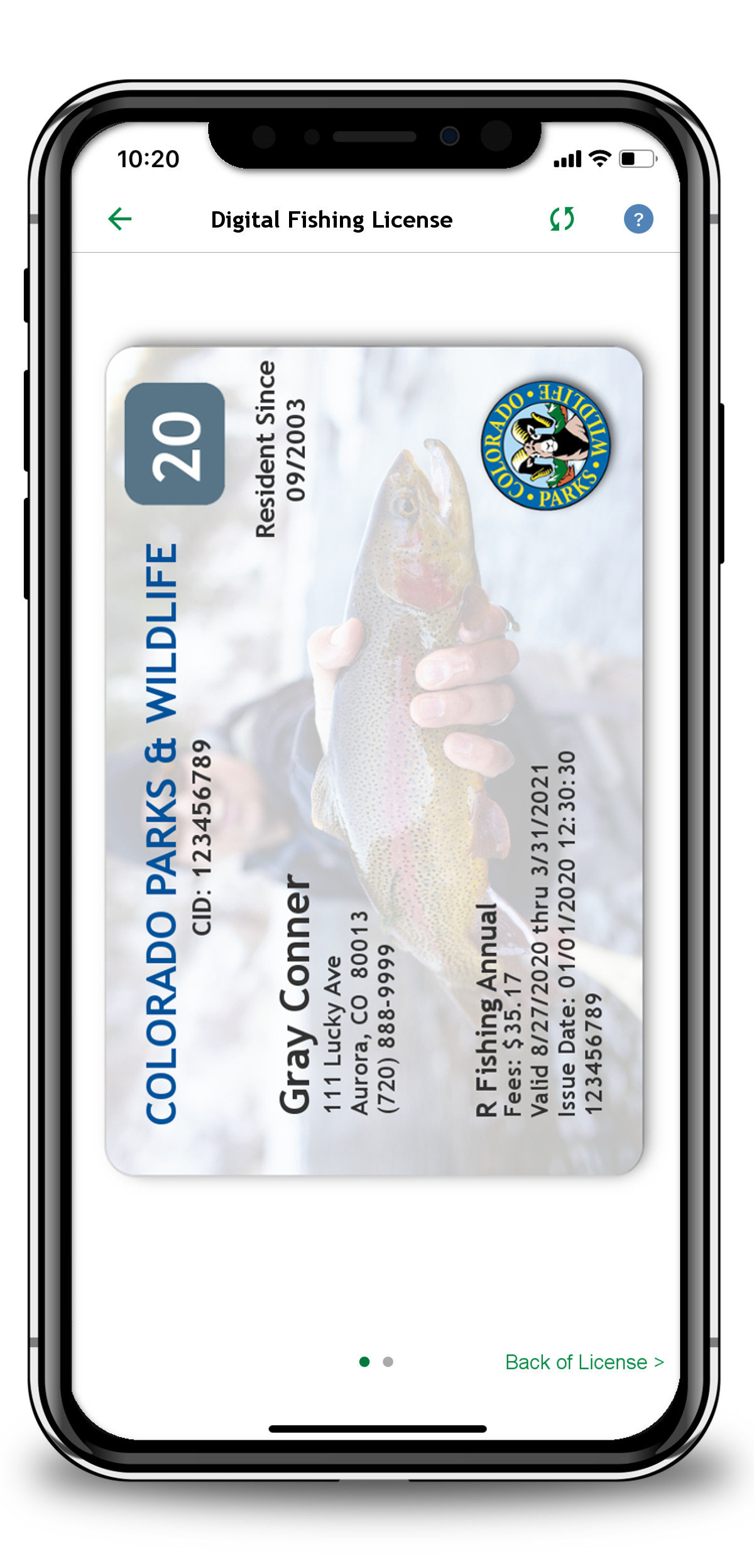

Mycolorado Gov Mycoloradogov Twitter

How Do I Register For A Colorado Sales Tax License When Starting A New Fitness Business

Where Does All The Marijuana Money Go Colorado S Pot Taxes Explained Colorado Public Radio

Food Trucks Push Carts Tri County Health Department Official Website

Special Event Tax Return City Of Aurora